Leveraging Digital Identity for your business

By Vishakh Venugopal |

|

5 mins read |

Abstract:

Digital Identity has well earned its place in the top 10 technology trends in the world. Amidst unprecedented times brought on by a global pandemic, minimal friction access to digital services became more important than ever. Suddenly, onboarding services had to adapt to a demand for complete online services across large corporations, governmental services, and small businesses. Reducing barriers to entry meant compromising on secure and validated access to services. This is where digital identity tech shone and became more relevant than ever. The aim was to integrate it into business processes, reduce the need for physical contact, and guarantee secure and validated access for consumers.

By harnessing the power of digital identity, one of our latest customers at Arrk has developed an interesting value proposition for their product suite. Therefore, staying ahead of the curve before the pandemic would be critical to the identity technology world.

Digital tech solutions and products can be overwhelming, making it hard to focus on product market fit. The key focus was to ensure we understand the business context of the problem well, develop an apt value proposition, and choose the right technology fit.

Context: The idea was to offer a proof-of-age product to consumers along with the incumbent product suite. They needed an online application and payment for the original process, but most of the verification had to be done in person. The framework was a useful tool to combat underage fraud, but had a major barrier to entry.

Arrk researched this proposition with product owners, business stakeholders, and auditors from the compliance organisations that owned the framework. Using iterative discovery techniques, we uncovered existing pain points in the process with current stakeholders and made well-received proposals around transforming the current process into a completely online process that would allow applicants to complete the process. Our Customer will be the first to implement a 100% digital solution for compliance. This framework will remain relevant and viable in the future because of our Customer’s implementation.

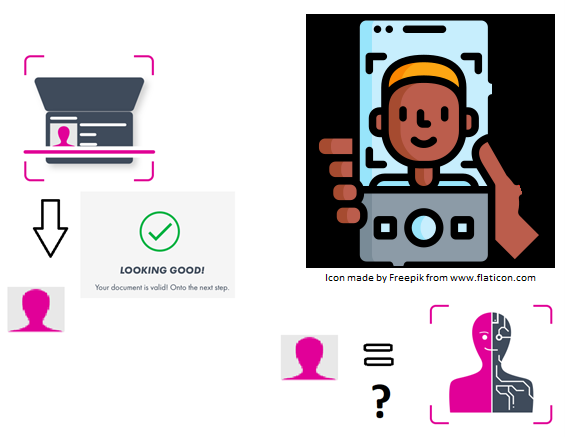

Proposition Development: Ensuring proper product market fit was the main focus of the proposal development phase. As-is process mapping of customer needs and pain points in their journey to access services from retailers and establishments was conducted with experience interviews with customers. This helped tailor the onboarding journey to cover users who would opt for this special product. Avoiding messaging confusion and disruption to the onboarding journey was important. Two principal components of the use case of digital identity verification for any business are:

- Verifying the identity of the person

- Validating that the person accessing the service is the same person who performed step 1

The original ID verification process involved the user providing valid documents and the verifier verifying that the correct person was applying. A digital solution was needed to replace the verifier’s actions.

Technology fitment:

We understood from the previous phase that an IDVT solution would be the best option. We thus began to speak to tech vendors to help our customer partner choose the best solution.:

- A document authentication via scan

- Accurately recording customer data with minimal data loss via OCR

- Native mobile SDKs, as user research verified, would work best in a mobile environment with phone cameras

- Face-match technology to validate the user applying is the same as recognized in a passed document check

- Validation that 2D images were not used to bypass face-match technology

- A vendor with extensive documents and expertise for document fraud cases

We finally partnered with a notable UK IDV and included their mobile SDKs into our Android and iOS apps. With an in-depth understanding of the problem space and now the solution space, we could leverage all aspects of the technology available like fine-tuning face-match thresholds, and ensuring a live person was applying by performing real-time expressions to prove their actual presence when applying among many others. All this is for the end user from the comfort of their homes on their mobile phone.

Post development:

Our customer went on to sell 100k+ of these ID-backed products. We tailored customer support to the auditory and compliance requirements. The solution also needed to be GDPR compliant.

A few months down the line, the same IDV concept was incorporated into a greenfield product licensed as a B2B service to the customer’s partners for onboarding the latter’s customers at the peak of the pandemic.

Based on the above experiences we have had, here are some tips for implementing your identity solution.

- UX is still King!

Just leveraging digital ID tech is not enough. The instructions to users and messaging throughout the process need to be as consistent. As a thumb rule, consider that a good 80% of your user base will have never attempted something similar. We faced complexities of face-match and verification, as well as the quality of photograph requirements. One has to explicitly inform users of what aspects can go wrong and what they need to do next.. Drop-offs are an even bigger risk with ID verification as it is still novel in many parts of the world.

- Pay attention to the on-demand cost of verification

Most services will charge on demand on a cost-per-verification basis. Work out bulk propositions with vendors and ensure that they are constantly improving the quality of verifications so you are paying only for valid verification attempts. Again a clear and consistent user experience helps to ensure users aren’t struggling continuously and burning through your total accounted-for service cost. Limit the number of user attempts before they need help for support intervention. Issues may arise from users’ incorrect instructions, outdated device support, or unlisted document formats in vendors’ databanks.

- Continuously improve

Things are advancing rapidly in this space and your vendor may make upgrades to their SDKs. Make sure you stay abreast and watch out for anything that reduces customer friction.

- Understand limitations:

It’s important to be transparent about the limitation of image recognition technologies and potential pitfalls it may bring. Face-match and AI algorithms are constantly evolving and often start off working on limited datasets and ethnicities. It’s important to recognize the impacts to your business early and make provisions. e.g. We were using a human face recognizing algorithm from a famous cloud provider prior to the identity verification to ensure users didn’t mistakenly upload their ID card photos as the actual photograph or photos of their pets! The AI had difficulty recognizing non-Caucasian faces, so we lowered the acceptance threshold. Imagine if 50% of your user base was an international audience!

With the right expertise backing your proposition, Digital ID tech can improve onboarding processes, save time and resources, and detect fraud faster than human eyes. Even if compliance requires you to still have manual checks in place. IDV helps speed the process regardless by aiding decision-making.

For more information on how we can help you on leveraging Digital Identity for your value proposition, contact us at talktous@arrkgroup.com