A New Era in Commercial Lending

Download our full report below…

Traditional lenders have steered clear of the SME market in recent years – but that’s changing. What was once considered an unprofitable sector, incumbents and new market participants have started to look to SME funding as the next big growth area. But the market has high expectations.

Our latest study – conducted in partnership with Populus – considers the thoughts and experiences of SME Directors when acquiring finance for their business. The study explores the importance of certain features and highlights possible improvements that could be made to the lending process to ensure a maximised experience for the borrower.

In particular, we examined:

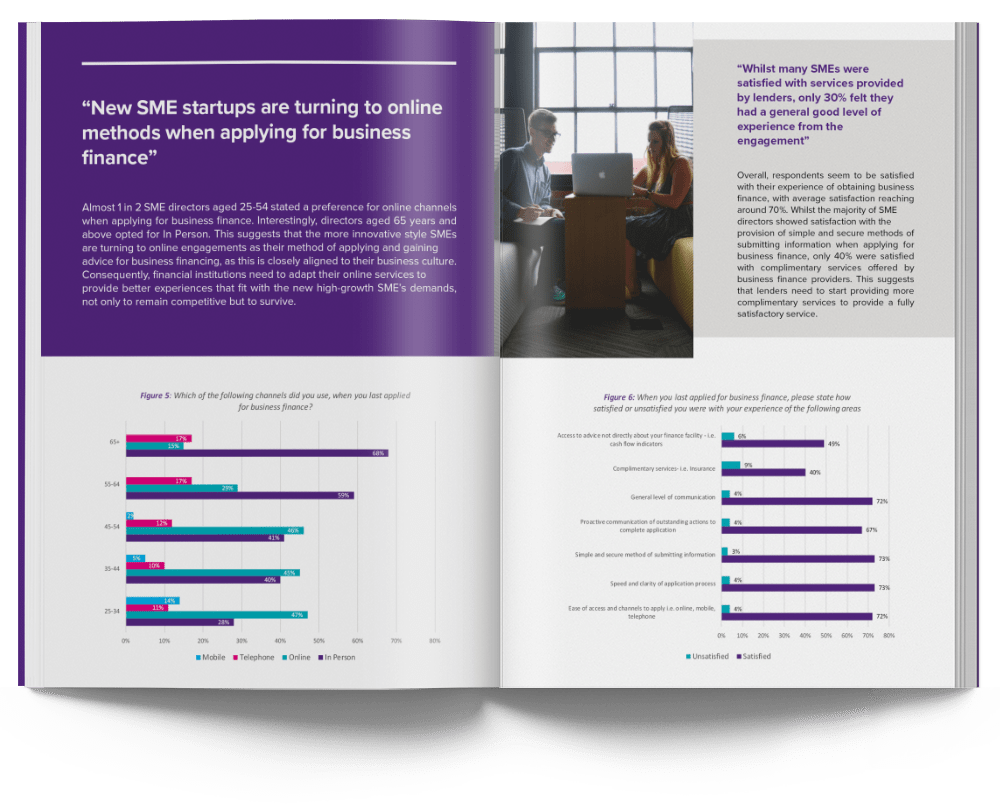

- The current state of the borrowing experience for SME Directors when applying for business finance

- The levels of satisfaction felt with various aspects of the overall borrowing experience

- Which features generate the best experience, from the first point of applying through to receiving funds

- Which features could improve the overall customer experience in the future

Download the report

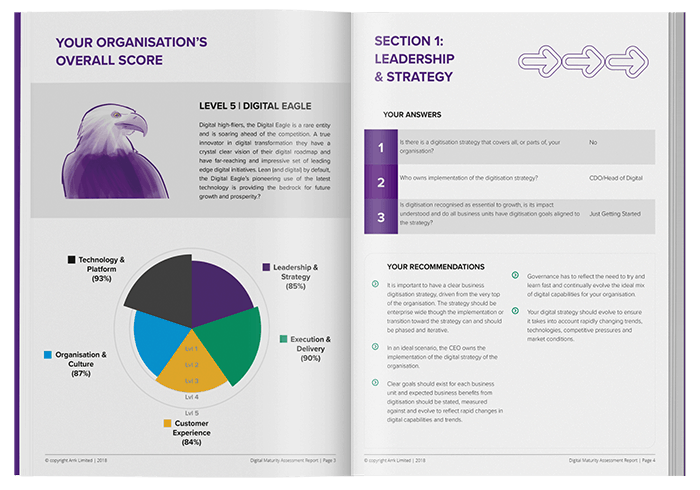

Discover your Organisation's Digital Maturity

Complete our online assessment and receive a personal report on the digital health of your business